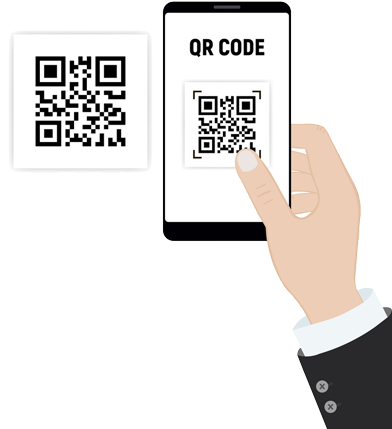

One QR Code for all Payments

Revolutionize your business with InterActive QRIS - the QR payment solution that goes beyond transactions. Seamlessly integrated with our P.O.S. system, accounting software, mobile attendance application, management consultation, and more, in InterActive we're not just enhancing payments; we're empowering your entire business ecosystem.

QRIS is Quick Response Code Indonesian Standard is a National QR code standard to facilitate QR code payments in Indonesia which was launched by Bank Indonesia and the Indonesian Payment System Association (ASPI) on August 17, 2019.

InterActive QRIS is a form of support for PT. InterAktif Internasional to support Bank Indonesia QRIS program in promoting a cashless society (digital money payments).

Our mission is to empower micro, small, and medium businesses across Indonesia through innovative payment solutions. InterActive QRIS is designed to enhance your payment experience while driving efficiency and growth across all aspects of your business.

InterActive QRIS has many advantages over other QRIS, because only InterActive QRIS has many advantages over other QRIS, because it is only

InterActive QRIS is more than just a payment tool; it's the cornerstone of your business operations. Seamlessly connect your P.O.S. system, accounting software, attendance tracking, and consulting services to unlock new levels of efficiency and profitability.

Empower your decision-making with real-time data from every corner of your business. InterActive QRIS offers comprehensive analytics that help you make informed choices and stay ahead of the competition.

We're not just a service provider, we're your growth partner. InterActive QRIS is designed to evolve with your business, offering the flexibility and scalability needed to succeed in today's dynamic market.

Articles of Law Requirements to use QR Code based on National standard QRIS as of January 1, 2020

Following the trend of digital non-cash payments Potential for sales expansion due to alternative payments other than cash.

Increased sales traffic.

Reduction in cash/small cash management costs:

Reduced risk of loss due to receiving payments with counterfeit money.

Transactions are recorded automatically and transaction history can be seen.

Building a credit profile for banks, the opportunity to get working capital becomes bigger.

Ease of paying bills, levies, purchasing goods non-cash without leaving the store.

Participate in government programs (BI, Ministries and Local Government).

QR Code standardization with QRIS provides many benefits, including:

Utilizing the Latest QR Code Technology

Easy download, registration and transaction

Use on All Kinds of Merchants

Transactions Without Using Cash